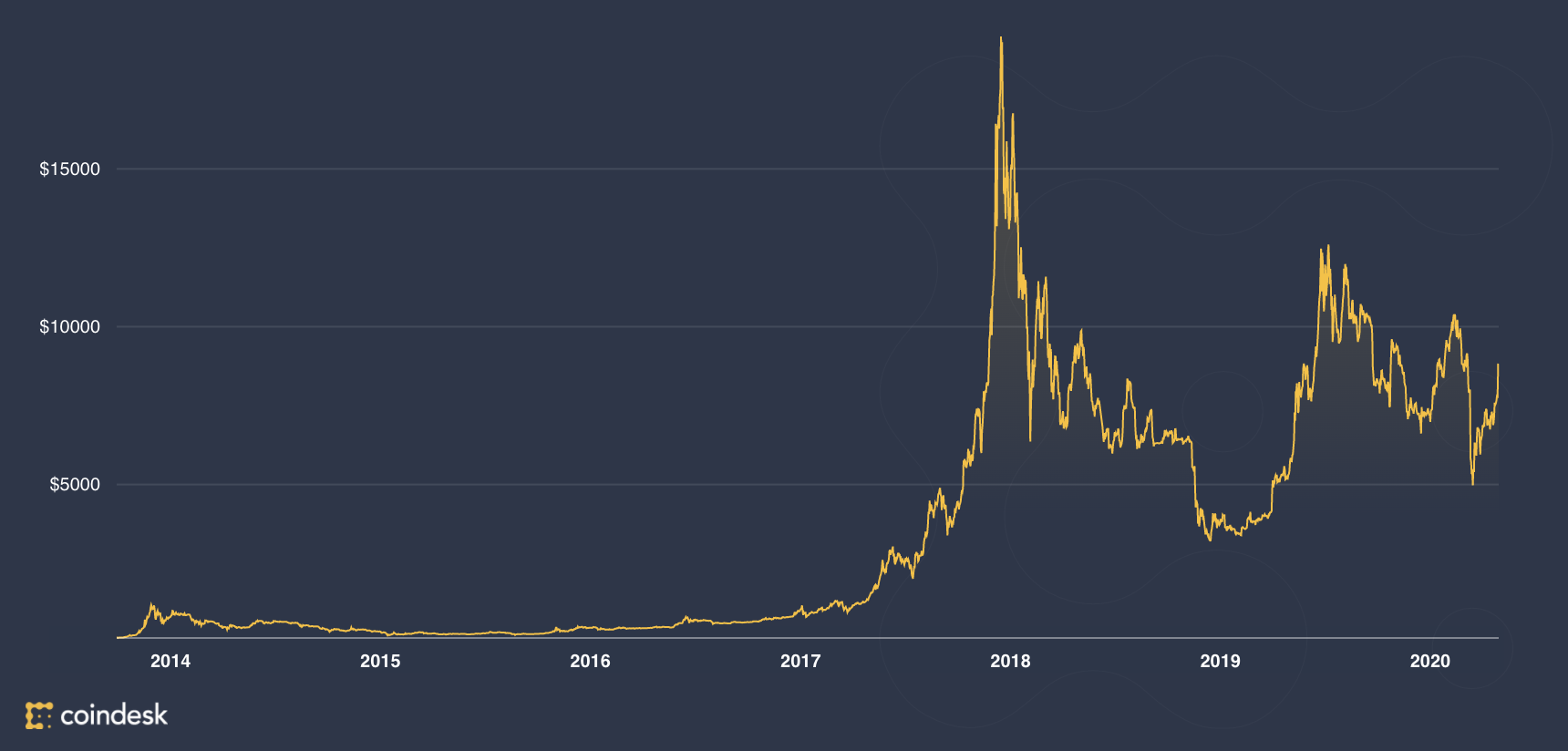

Tesla CEO Elon Musk is making a huge amount of careless tweets, and the sun is out, so now appears to be a decent time to blog. I have a contention for why Musk tweeting that Tesla’s stock cost is excessively high—hypothetically a crazy thing for a CEO to do, particularly given that he’s now been banned by the SEC from tweeting about Tesla stock without consent—is the least outrageous thing he’s tweeted today. It includes Bitcoin, on the grounds that genuinely we as a whole kicked the bucket in 2012 and the truth is currently a Möbius piece of discipline. After Musk’s tweet, Tesla stock quickly fell by more than 10 percent. Two things initial: One, Musk likening life-sparing social separating measures to totalitarianism is ludicrous and reckless. Two, underestimate that Tesla financial specialists, particularly of the more easygoing Robinhood stock-picker assortment, alongside Tesla stans are losing it over Elon’s tweet today. I would be as well, in the event that I’d overindexed on one stock that the CEO just failed in an unhinged online fever dream. These are people who trust in Musk not as a result of the first and excellent Tesla fantasy about sparing the planet, but since Tesla stock has a development bend like Bitcoin. Truly, investigate:

I got the Bitcoin tracker from Coindesk, which doesn’t go far enough back to follow Bitcoin’s cost when it was under $100 in the good ‘ol days, yet these diagrams have four eminent, comparative highlights: an early top (for Bitcoin, this sadly begins where the chart indicated begins, as Bitcoin hit its first significant value top as it got bunches of consideration in 2013 and 2014), a long trough, and later two pinnacles about 5-10x in size, trailed by a shorter trough. Tesla and Bitcoin aren’t similar in actually any manner other than one pivotal thing identified with their value: Tesla’s stock worth and Bitcoin’s own worth have both been drastically impacted, not only by the “advertise cost” of the worth they make, however by the brain science of both being resources that are profoundly conspicuous, effectively obtained, and (essentially) apparently “cloud” enough that on the off chance that you are aware of everything, you can get rich. More on that in a second. In any case, to help this contention, take the way that vehicle organization CEOs have perpetually befuddled why Tesla is worth so much when it makes similarly scarcely any vehicles (isn’t the market judicious), and for Bitcoin, simply take the way that its cost has never been soundly pegged to its utility as a money elective. Rather, the costs of both are vulnerable to a similar promotion cycle, based around four occasions in the lifecycle of a much-advertised, darken tech venture that interests to a specific sort of financial specialist searching for 10x increases. Initially, the most significant part is that every ha clear “early adopter bubbles” that manufactured intense, out of control fanbases concentrated on the way that they made a huge amount of cash incredibly rapidly. Both of these air pockets at that point popped in light of the fact that there wasn’t in reality enough major utility/showcase accomplishment for either substance to continue that underlying air pocket. Things settled down, however this underlying air pocket does two pivotal things: First, it gives a demonstrated account of an advantage’s capacity to develop in esteem rapidly, paying little heed to if that is sound or repeatable. Second, it makes an enormous fanbase of speculators who have the tales to recount their tremendous increases and each impetus to keep that story alive. Critically, in the long haul, these first air pockets look small now however they were colossal development at that point. That reality is every one of the one needs to continue converting. That underlying air pocket is driven by individuals who really are wise financial specialists somehow. They thought about something hot before others did, and were sufficient in the scene to comprehend what they were purchasing. They’re not going to hurt really awful when the stock/Bitcoin costs right themselves, which is the reason we have a long trough to follow. Certainly, everybody got energized there for a moment, yet we should be genuine: both Bitcoin and Tesla weren’t prepared to support that degree of desire. So you have a couple of long stretches of development for the organization/digital currency that irons out a huge amount of basics; Bitcoin got simpler to utilize, Tesla began making and selling a mess of decent vehicles. They were, for purpose of me being succinct here, prevailing at their utilitarian objective in manners they weren’t during their first air pocket. This is something worth being thankful for, so is there any valid reason why this wouldn’t achievement drive their costs higher? All things considered, absence of consideration is a certain something; negative consideration and distrust following a burst bubble is another. In any case, in all probability this is really when both were valued accurately. You see some moderate, consistent development proportionate with the accomplishments of the two substances, which is the thing that you’d expect since the crucial yield of each expects them to develop more straightly than the unadulterated exponential-development tech elements they were seen as by speculators in their first air pocket. As both Tesla and Bitcoin improved their basics, the two of them had clever, exceptionally vocal fanbases of financial specialists who a) had earlier successes in the primary air pocket to demonstrate their bonafides and b) each motivation to point at every achievement and state “see, trust us, this thing is going to go to the moon once more.” In the long run, the entirety of that achievement as-a-helpful item development and here-comes-another-blast talk continues an altogether greater development, driven by the way that a) there is the intense fanbase from the primary blast, b) long periods of those individuals highlighting “simply trust us, it’s prepared to blow!”, and c) the cost quickening mental impact of hitting new value tops following quite a while of torpid development. Nobody needs to pass up a definite wager, particularly in the consecrated 10x universe of exceptionally plugged tech speculations, so this next pinnacle is HUGE, continuing the legend. This pinnacle is unreasonable as well, yet dissimilar to that absolute first air pocket quite a while in the past, this pinnacle is based on an establishment of stress. It’s not propped up by a lot of financial specialists who comprehend a decent generally alright to take a flyer on it, similar to each early Bitcoin individual did, yet on the minor thought that a stock needs to go up, in light of the fact that everybody is discussing it! That is to say, truly, I have definitely no clue what’s really going on in Tesla processing plants. Is it accurate to say that they are working admirably or not? Who knows! Big-time institutional financial specialists would, however I have no clue. At last however, that is immaterial, in light of the fact that I’m not purchasing a potential quick development stock like Tesla dependent on whether the cost is situated as a general rule, I’m getting it dependent on whether I want to get rich as poop actually rapidly! What’s more, for that, financial specialists just need the IDEA that it can go up, and purchase in from other fleeting trend speculators who are additionally purchasing in. You know the story at this point: everything returns colliding with Earth, but instead than the underlying little, intense, over the top fanbase, presently you have an entire bundle of NEW people who considered the to be to get 10x as wealthy in a fraction of the time in an altogether increasingly develop advertise (which is inconceivable), thus they all lose their goddamn crap through the following trough, and this consideration (and shrewd account working by Tesla) quickens into a subsequent pinnacle. On account of Bitcoin, the cost settled some place around a large portion of its tops as a lot of individuals lost their cash and left, and others hung on figuring they could stand to hang tight for more development. And up and down the first grifters got paid, however the people who lost by purchasing past the point of no return on the first and second pinnacles lost their psyches (and wallets). At long last, the Bitcoin framework has been so lastingly stalled by blast and bust cycles, with many force players moving in and out throughout the years, that it’s moved into a world a mess not the same as its unique guarantee. Musk is completely saturated with the VC-to-discussion banner publicity cycle laid out above, so I need to accept he realizes that in the end valuations can get so high—not founded on real item achievement yet on the brain research of wannabe exponential development financial specialists—that investor requests wind up controlling the organization more than he’d like, particularly since he assumes over the top responsibility for the organization’s picture, activities, and stock cost. So I would not be astounded that in a mental breakthrough, he chose to tank the stock since significant expenses and elevated standards from stans were setting him up for more long haul investigation than him being in a tough situation with the SEC present moment. Furthermore, perhaps then the Tesla cost balances out again with lower desires as he keeps on attempting to fabricate a beneficial vehicle organization amidst a worldwide financial breakdown, which is hard enough without a lot of Bless You Stonks God answer folks and r/WallStreetBets brothers battering your notices for quite a long time by beseeching you to spare them from monetary ruin by multiplying their Tesla interest in the following three weeks.